Gross Income To Net Income Calculator Canada

Gross annual income - Taxes - Surtax - CPP - EI Net annual salary. C 2461 1868 1676.

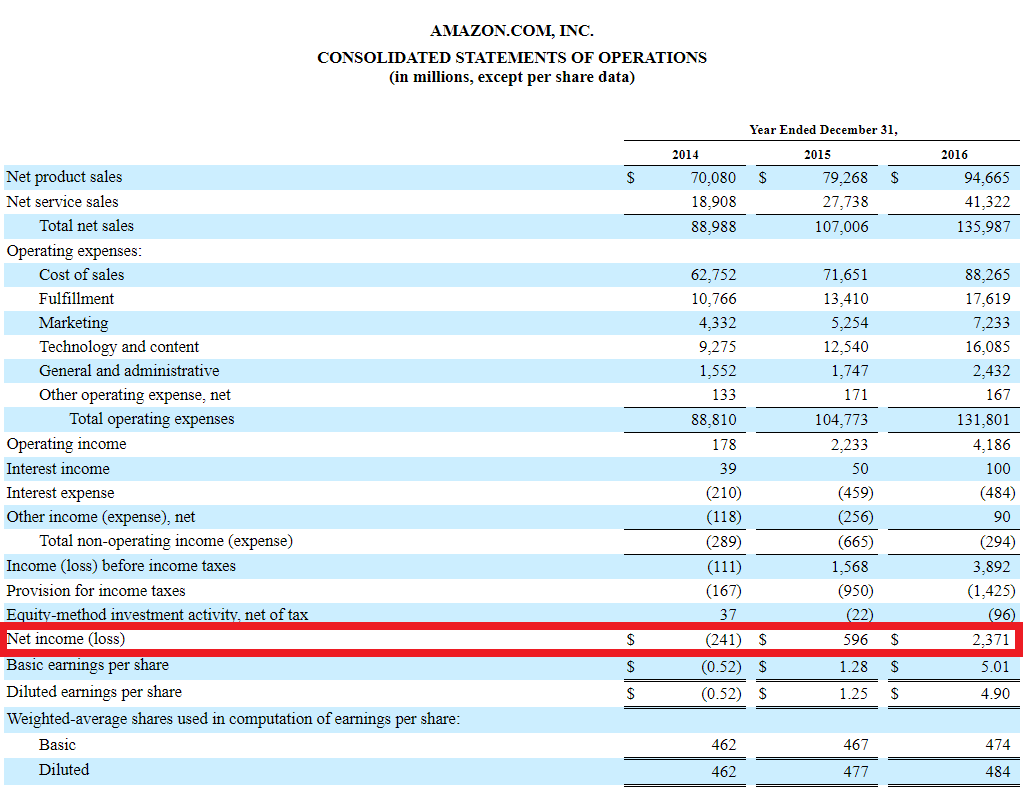

What Is Net Operating Profit After Tax Nopat Formula Definition Quickbooks

C 29527 22410 20109.

Gross income to net income calculator canada. This is the total amount of net income you make in a month. Step 3 Net income. Do you have a part-time job or earn money from a side hustle.

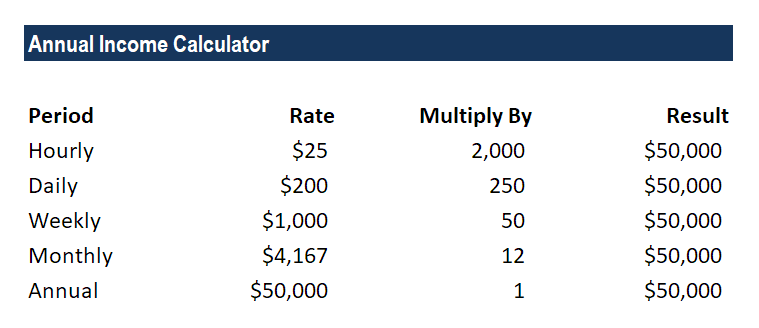

The 75 household income in Canada earns 21811. Find out how much money you could get if you file a tax return this year. Each calculator provides the same analysis of pay but is simplified to allow you to enter your salary based on how you are used to being paid hourly daily etc.

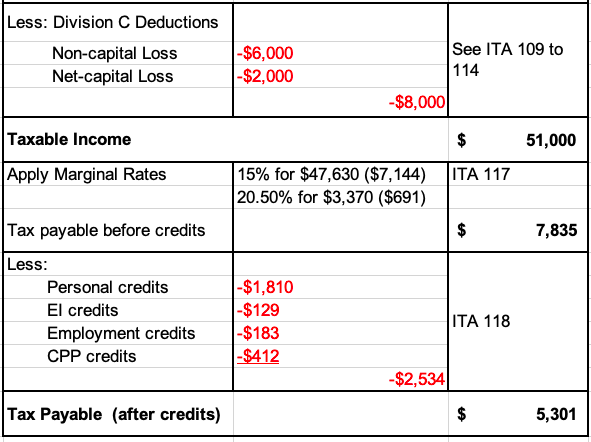

Step 4 Taxable income. The 1 household income in Canada earns 306710. The 10 household income in Canada earns 122274.

The annual net income is calculated by subtracting the amounts related to the tax Canada Tax and Ontario Tax the Ontario surtax the Canadian Pension Plan the Employment Insurance. Net annual salary Weeks of work year Net weekly income. One of a suite of free online calculators provided by the team at iCalculator.

Your average tax rate is 220 and your marginal tax rate is 353. Calculate your salary after tax by province compare salary after tax in different provinces with full income tax rates and thresholds for 2021. Formula for calculating net salary in BC.

Line 25600 Additional deductions. Find tech jobs in Canada. Get started for free.

Net income is used to calculate federal and provincial or territorial non-refundable tax credits. If you make 52000 a year living in the region of Ontario Canada you will be taxed 11432. Start by entering your monthly income.

Gross annual income Taxes CPP EI Net annual salary Net annual salary Weeks of work year Net weekly income Net weekly income Hours of work week Net hourly wage. The CRA also uses your net income and if you are married or living common-law your spouse or common-law partners net income to calculate amounts such as the Canada child benefit the GSTHST credit the social benefits repayment and certain. The annual net income is calculated by subtracting the amounts related to the tax Canada Tax and Ontario Tax the Ontario surtax the Canadian Pension Plan the Employment Insurance.

The 25 household income in Canada earns 78820. The 50 household income in Canada earns 44807. Salary after Tax is an easy-to-use online calculator for computing your monthly or yearly net salary based on the local fiscal regulations for 2021.

FREE gross to net paycheck calculator and other pay check calculators to help consumers. Formula for calculating net salary. Rates are up to date as of June 22 2021.

Online salary calculator for each province in Canada. Canada Tax Calculators Select a specific online tax calculator from the list below to calculate your annual gross salary and net take home pay after deductions. Line 25000 Other payments deduction.

This marginal tax rate means that your immediate additional income will be taxed at this rate. After-tax income is your total income net of federal tax provincial tax and payroll tax. A minimum base salary for Software Developers DevOps QA and other tech professionals in Canada starts at C 85000 per year.

Gross annual income Taxes Surtax CPP EI Net annual salary. Net annual salary Weeks of work year Net weekly income. Line 25300 Net capital losses of other years.

Using the Debt to Income Ratio Calculator. We use net after-tax instead of gross before tax because you make debt payments with money after taxes. Line 23600 Net income.

These calculations are approximate and include the following non-refundable tax credits. The 5 household income in Canada earns 157486. That means that your net pay will be 40568 per year or 3381 per month.

The basic personal tax amount CPPQPP QPIP and EI premiums and the Canada employment amount.

How To Calculate Net Income 12 Steps With Pictures Wikihow

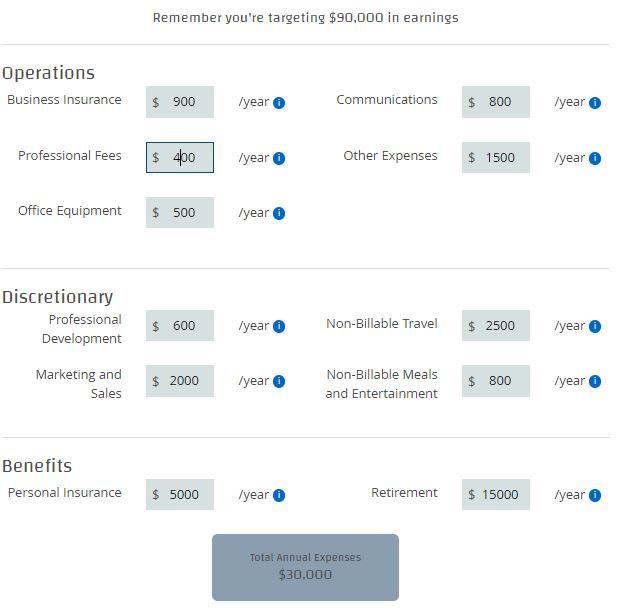

What Is Gross Vs Net Income Definitions And How To Calculate Mbo Partners

How To Create An Income Tax Calculator In Excel Youtube

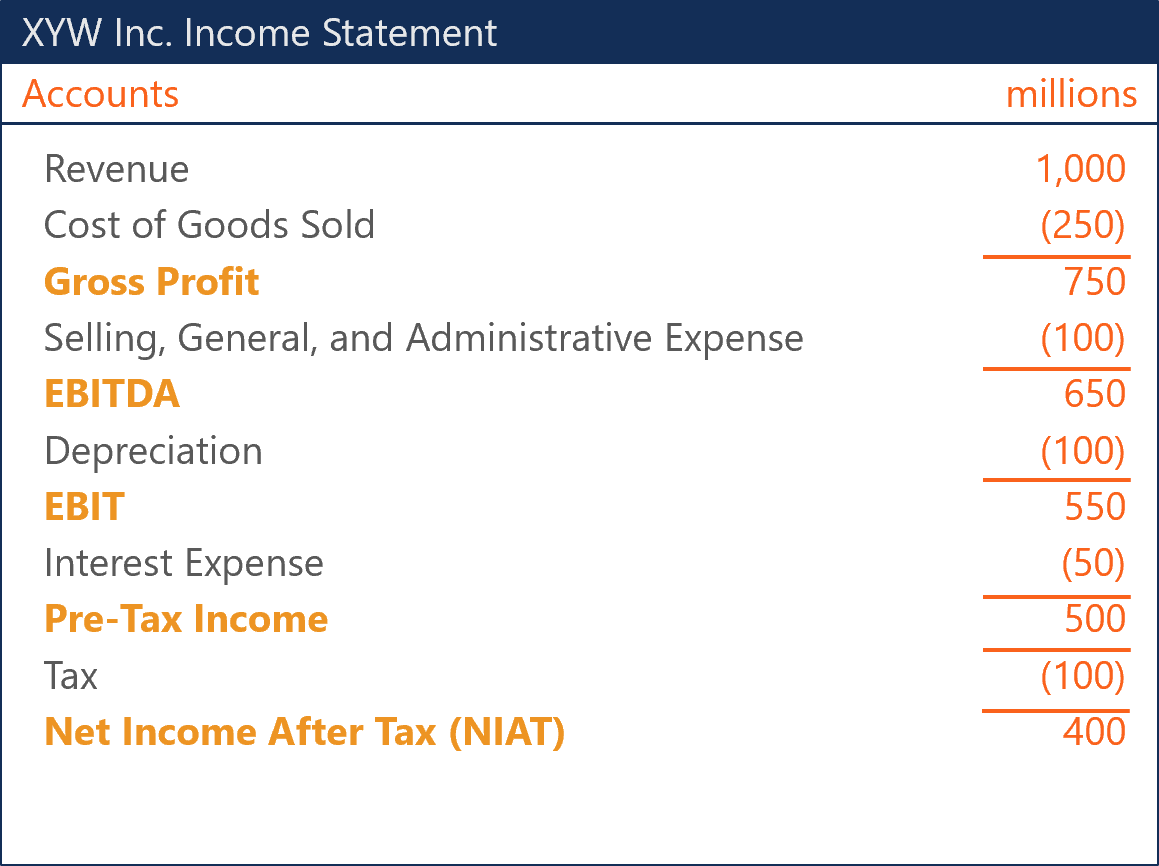

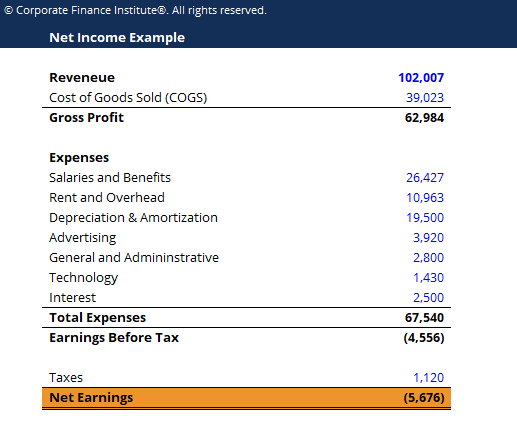

Net Income After Tax Niat Overview How To Calculate Analysis

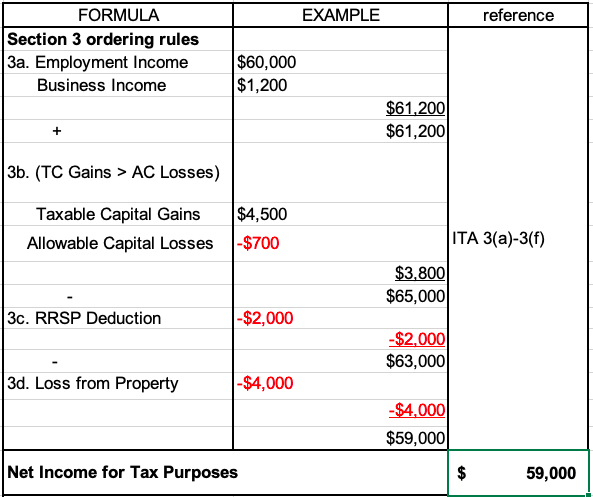

How Do You Get From Net Income For Tax Purposes To Taxable Income To Tax Payable Intermediate Canadian Tax

5 3 Explanation Interpretation Of Article V Under U S Law Canada U S Tax Treaty Rental Income Interpretation Real Estate Rentals

Net Income The Profit Of A Business After Deducting Expenses

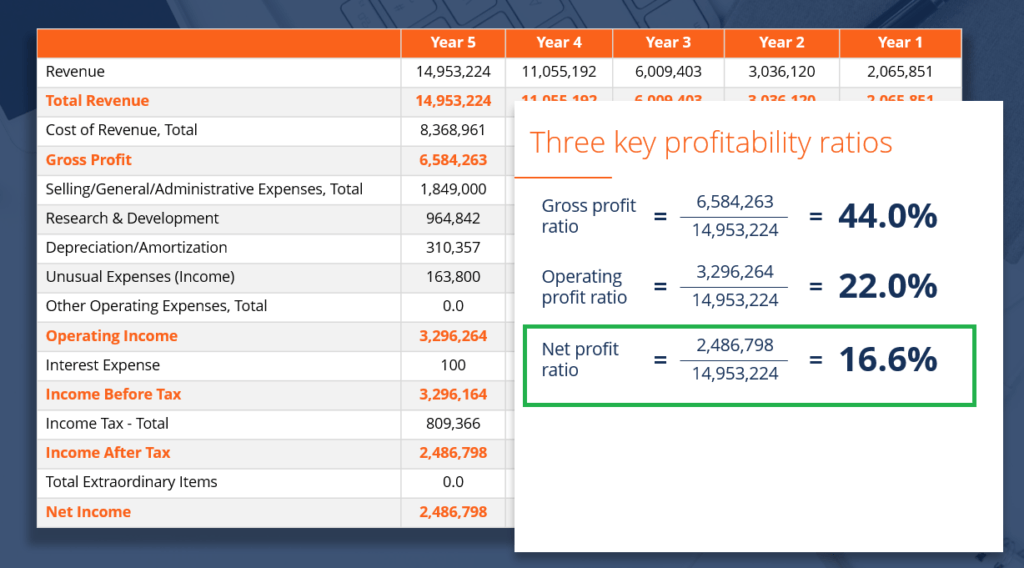

Net Profit Margin Definition Formula And Example Calculation

Excel Formula Income Tax Bracket Calculation Exceljet

Annual Income Learn How To Calculate Total Annual Income

Net Salary Calculator Canada Salary Calculator Bad Credit Mortgage Online Mortgage

How Do You Get From Net Income For Tax Purposes To Taxable Income To Tax Payable Intermediate Canadian Tax

Online Income Tax Calculator Calculate Income Taxes For Fy 2020 21 Scripbox

Net Income Template Download Free Excel Template

Earning Yield Calculator Www Investingcalculator Org Earnings Calculator Html Investing Investment Calculator Financial Calculators Earnings Calculator

Return On Equity Calculator Www Investingcalculator Org Return On Equity Html Investing Investment Calcu Return On Equity Financial Calculators Investing

Free Dividend Payout Ratio Calculator Investingcalculator

How To Calculate Net Income 12 Steps With Pictures Wikihow

:max_bytes(150000):strip_icc()/AppleIncomeSattementDec2019-cd967d0a8f5e4748a1060f83a7e7acbc.jpg)

Post a Comment for "Gross Income To Net Income Calculator Canada"