Gross Income Ppp Loan Calculator

Individual partners may not apply for separate PPP loans. Receive a non-binding offer and sign with BankId.

![]()

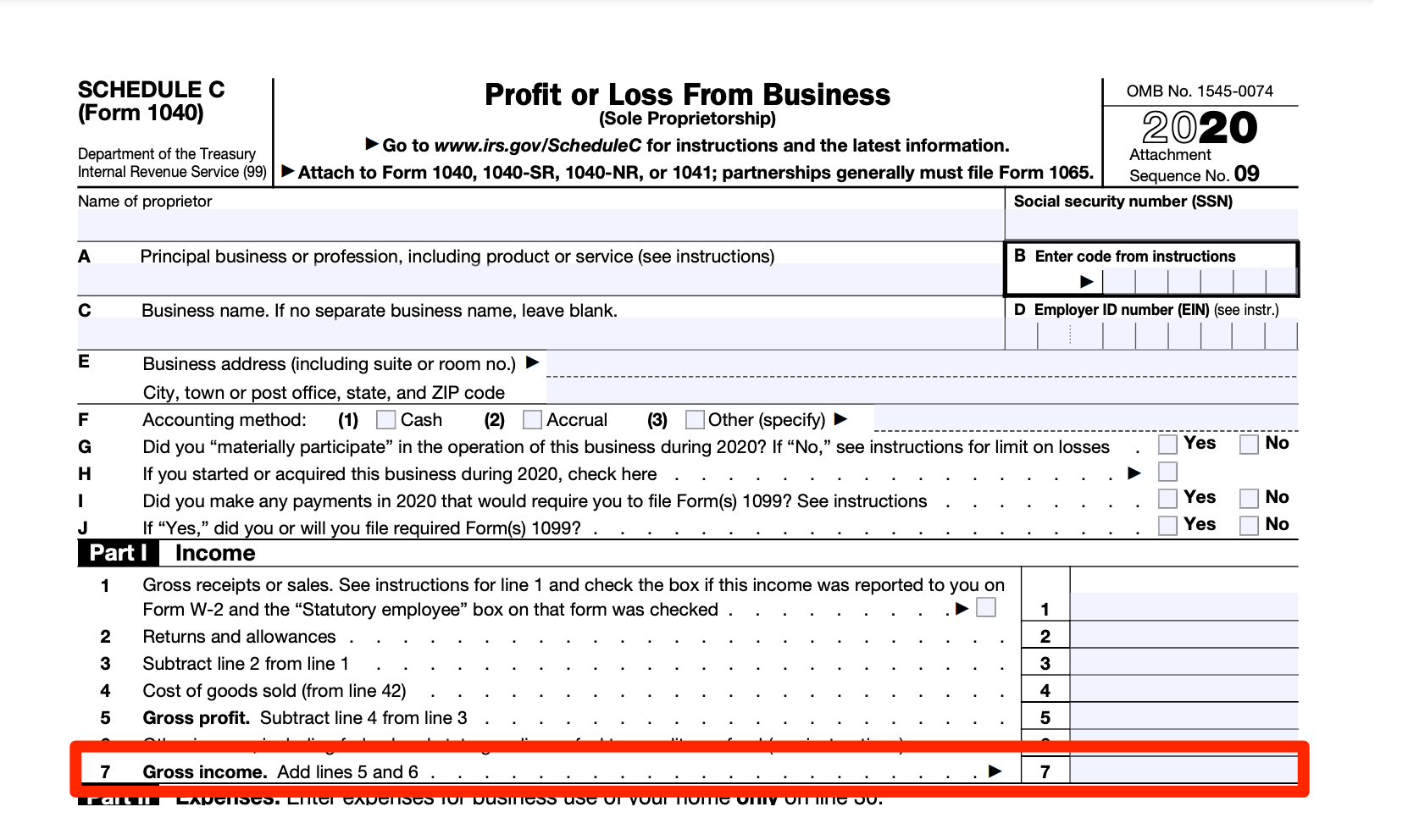

New Ppp Loan Calculations For Sole Proprietors Cfoshare

As of 03032021 you can calculate your PPP based on either gross income line 7 or net income line 31.

Gross income ppp loan calculator. PPP loans are calculated using the average monthly cost of the salaries of you and your employees. Your salary as an owner is defined by the way your business is taxed. Gross Income PPP loan calculator for Schedule C filers - Updated March 3 2021 by Hannah Smolinski.

Small Business Administration Paycheck Protection Program PPP loans Friday April 10 2020 the SBA issued an interim final rule on how Schedule C sole proprietors and individual partners in a partnership should treat their self-employment income regarding the PPP loan process. The new IFR allows a Schedule C filer who has yet to be approved for a PPP first- or second-draw loan in the current 2845 billion phase of the program to elect to calculate the owner compensation share of its payroll costs based on either net profit as reported on line 31 of Schedule C or gross income as reported on line 7 of Schedule C. How to Calculate PPP Loan Amount Using Gross Income - YouTube.

This is your profit after expenses line 31 of your Schedule C. Note that owners compensation is still limited to 100kyr. Receive a non-binding offer and sign with BankId.

PPP For Self Employed. Wait time between First and Second Draw PPP. Annons Förverkliga en idé möjliggör ett projekt eller köp något som du längtar efter.

PPP For Self Employed. Second-draw PPP borrowers those borrowing a second PPP loan who do file Form 1040 Schedule C and elect to use gross income to make the loan maximum calculation should use this form. How to Calculate PPP Loan Amount Using Gross Income.

Receive a non-binding with low interest. If both your net profit and gross income are zero or less you are not eligible for a PPP loan. The new rule allows that a Schedule C filer who has yet to be approved for a PPP first- or second-draw loan in the current phase of the program can elect to calculate the owner compensation share of its.

Vi är specialister på ansvarsfull kreditgivning. Calculate the average monthly net profit or gross income amount divide the amount from Step 1 by 12. SBA Releases New PPP AppGuidance for Gross Income line 7 Schedule C Calculation.

Well get into more details below about the calculation differences between different entity types. Gross Income is always higher than Net Profit or at least the same By using this figure most business owners will now have significantly higher owners compensation and thus PPP loan amounts. With independent contractors and self-employed individuals becoming eligible to apply for US.

Multiply the average monthly net profit or gross. Application or on separate PPP loan applications for each partner. How PPP loans are calculated.

The change opens the door for larger loans to self-employed. Gross vs Net income. The following methodology should be used to calculate the maximum amount that can be borrowed for partnerships partners self-employment income should be included on the partnerships PPP loan application.

Annons Loan without security. Note that PPP loan forgiveness amounts will depend in part on the total amount spent during the covered period following disbursement of the PPP loan Answer. Vi är specialister på ansvarsfull kreditgivning.

Small Business Administration SBA issued new Paycheck Protection Program PPP rules that allow self-employed individuals who file Form 1040 Schedule C Profit or Loss From Business to calculate their maximum loan amount using gross income instead of net profit. Annons Loan without security. Annons Förverkliga en idé möjliggör ett projekt eller köp något som du längtar efter.

When calculating PPP loan. If youre a sole proprietor or self-employed and file a Schedule C your PPP loan is calculated based on your business gross profit or gross income. March 3 2021.

This is your income before any expenses l ine 7 of your Schedule C. Anpassat lån efter dina behov. New PPP first-draw Form 2483-C and second-draw Form 2483-SD-C borrower application forms for Schedule C filers using gross income.

Receive a non-binding with low interest. Notice that is called the 2483-C They also released a new 2483 today that references this form for filers wishing to use the Gross calculation. Interactive PPP Loan Calculator.

Anpassat lån efter dina behov.

How To Calculate Labor Costs The Small Business Owner S Guide Labour Cost Small Business Finance Finance

Ppp For Self Employed How To Calculate Ppp Loan Amount Using Gross Income Youtube

Excel Payroll Calculator Template Software Download Payroll Template Excel Spreadsheets Templates Payroll

Download Adjusted Gross Income Calculator Excel Template Exceldatapro Adjusted Gross Income Income Excel Template

How To Calculate Gross Income For The Ppp Bench Accounting

![]()

Download Adjusted Gross Income Calculator Excel Template Exceldatapro Adjusted Gross Income Income Excel Template

Ppp Loan Based On Gross Income For Self Employed Teacher Entrepreneurs

How To Calculate Adjusted Gross Income Agi For Tax Purposes Adjusted Gross Income Health Savings Account Tax Accountant

How To Calculate Gross Income For The Ppp Bench Accounting

Tax Formula Tax Tax Deductions Above The Line

Are You Going To Be Ok In Retirement 1 Easy Calculation Can Provide The Answer Kiplinger In 2021 Personal Financial Advisor Retirement Smart Money

How To Calculate Your Paycheck Protection Program Loan Amount Bench Accounting

Ppp Loan Based On Gross Income For Self Employed Teacher Entrepreneurs

Post a Comment for "Gross Income Ppp Loan Calculator"