Net To Gross Income Calculator Quebec

C 2461 1868 1676. Canadian Payroll Calculator by PaymentEvolution.

Confluence Mobile Community Wiki

Net to Gross Paycheck Calculator This calculator helps you determine the gross paycheck needed to provide a required net amount.

Net to gross income calculator quebec. Please note where a net salary has been agreed the employer will be covering the employees pension contribution in addition to. First enter the net paycheck you require. It is free for simple tax returns or gives you 10.

The Quebec Income Tax Salary Calculator is updated 202122 tax year. Canadas Federal Taxes are calculated using the latest Personal Income Tax Rates and Thresholds for Quebec in 2021. Find tech jobs in Canada.

Gross Income for Tax Purposes. Income Tax calculations and RRSP factoring for 202122 with historical pay figures on average earnings in Canada for each market sector and location. The Quebec Income Tax Salary Calculator is updated 202122 tax year.

This tax calculator is used for income tax estimationPlease use Intuit TurboTax if you want to fill your tax return and get tax rebate for previous year. 7 rader Income Tax Calculator Quebec 2020. A minimum base salary for Software Developers DevOps QA and other tech professionals in Canada starts at C 85000 per year.

Net to Gross Income - Rise High. Salary calculations include gross annual income tax deductible elements such as Child Care Alimony and include family related. Calculate net pay based on gross salary income and the municipality you live in.

Calculator net salary quebec. PaymentEvolution provides simple fast and free payroll calculator and payroll deductions online calculator for accountants and small businesses across Canada. C 29527 22410 20109.

Were making it easier for you to process your payroll and give your employees a. 999 33250 subtract 5000 from calculated income 334. Income Tax calculations and RRSP factoring for 202122 with historical pay figures on average earnings in Canada for each market sector and location.

Gross annual income - Taxes - Surtax - CPP - EI Net annual salary. The annual net income is calculated by subtracting the amounts related to the tax Canada Tax and Ontario Tax the Ontario surtax the Canadian Pension Plan the Employment Insurance. 501 16700 subtract 5000 from calculated income If income is greater than 14601.

Use the calculator to work out an approximate gross wage from what your employee wants to take home. At the same time more leading roles like Software Architect Team Lead Tech Lead or Engineering. That means that your net pay will be 40512 per year or 3376 per month.

Calculate salary after taxes. Enter the net wage per week or per month and you will see the gross wage per week per month and per annum appear. If you make 52000 a year living in the region of Ontario Canada you will be taxed 11488.

Use our Income tax calculator to quickly estimate. This is income tax calculator for Québec province residents for year 2012-2020Quebec personal income tax rates are listed below and check this page for federal tax rates. The calculation is based on the Tax Agencys own tables.

Federal Tax Provincial Tax QPIP CPPQPP and EI premiums. Income Tax calculations and RRSP factoring for 202122 with historical pay figures on average earnings in Canada for each market sector and location. Your average tax rate is 221 and your marginal tax rate is 349.

Easy-to-use tax calculator for computing your net income in Canada after all taxes have been deducted from your gross income. This marginal tax rate means that your immediate additional income will be taxed at this rate. The Table below illustrates how Quebec Income tax is calculated on a 4000000 annual salary.

Salary calculations include gross annual income tax deductible elements such as Child Care Alimony and include family related tax. Net annual salary Weeks of work year Net weekly income. Formula for calculating net salary.

Confluence Mobile Community Wiki

Quebec Sales Tax Gst Qst Calculator 2021 Wowa Ca

Income Tax Calculator Calculatorscanada Ca

2021 Quebec Province Tax Calculator Canada

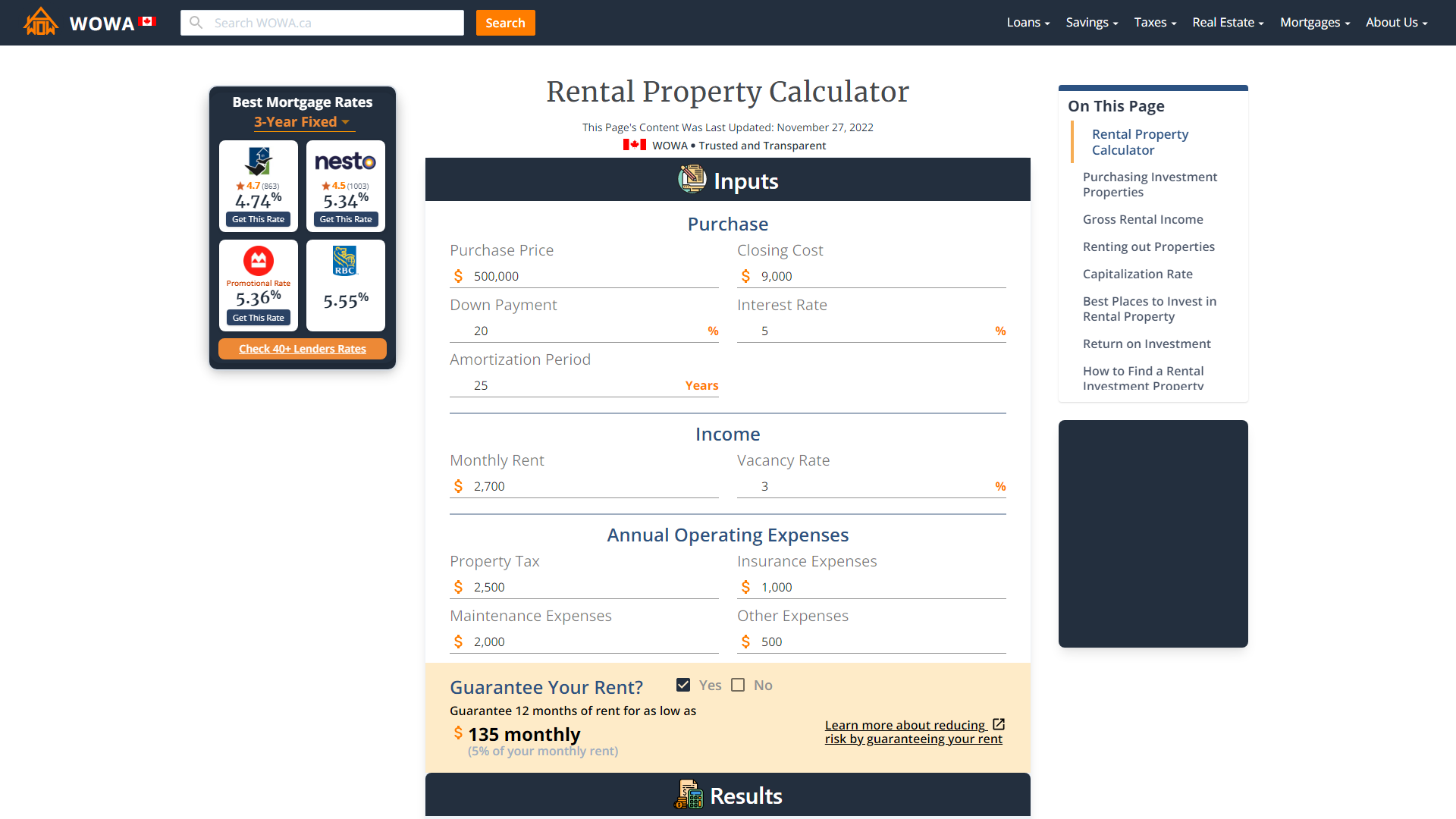

Rental Property Calculator 2021 Wowa Ca

Canada Global Payroll And Tax Information Guide Payslip

How Can A Self Employed Person Calculate The Net Income Is There Any Formula We Can Refer To Parents In Quebec Babycenter Canada

Quebec Income Calculator 2020 2021

Quebec Child Support Calculator Canada Child Support Guidelines

How To Calculate Payroll Tax Deductions Monster Ca

Gst Calculator Goods And Services Tax Calculation

How To Calculate Net Income 12 Steps With Pictures Wikihow

Canada Federal And Provincial Income Tax Calculator Wowa Ca

Avanti Gross Salary Calculator

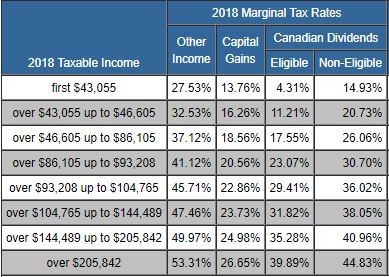

Taxtips Ca Quebec 2017 2018 Income Tax Rates

Canada Global Payroll And Tax Information Guide Payslip

Temporary Wage Subsidy For Employers How To Calc

Mathematics For Work And Everyday Life

Post a Comment for "Net To Gross Income Calculator Quebec"