Take Home Salary Massachusetts

Massachusetts 5k Salary Example. For example if an employee earns 1500 per week the individuals annual income would be 1500 x 52 78000.

10 Jobs With The Best Salary Potential Salary Guide Job Job Hunting

Must be willing to travel.

Take home salary massachusetts. Massachusetts 45k Salary Example. This free easy to use payroll calculator will calculate your take home pay. Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in Massachusetts.

Calculates Federal FICA Medicare and withholding taxes for all 50 states. We pay 35 per home visits. In Massachusetts these income levels would be taxed at a flat rate of 5.

The state sales tax rate in Massachusetts is 625. Taxpayers can choose either itemized deductions or the standard deduction but usually choose whichever results. While this calculator can be used for Massachusetts tax calculations by using the drop down menu provided you are able to change it to a different State.

At the high end all income over 1000000 is taxed at 133. 41 rader Average Salary Massachusetts Average salary in Massachusetts is 91819 USD per. At the low end all income from 0 to 8932 is taxed at 1 for 2020.

This Massachusetts hourly paycheck calculator is perfect for those who are paid on an hourly basis. We are looking for Per-Diem Care Manager to conduct non-skilled nursing home visits. Massachusetts Sales Tax.

Take-home salary for single filers. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. A list of Massachusetts State Employees salaries by year agency and employee.

Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in Massachusetts. Massachusetts 40k Salary Example. Massachusetts 10k Salary Example.

This scheme offers support to employers who bring their staff back to work gradually. Well do the math for youall you need to do is enter the applicable information on salary federal and state W-4s deductions and benefits. Massachusetts 25k Salary Example.

There are no additional local taxes collected so 625 is the rate you will pay regardless of where you are in the state. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. 71803 Take-home salary for married filers.

Massachusetts 20k Salary Example. Everyone pays the same tax rate except for those with very limited incomes who pay. Massachusetts 35k Salary Example.

Overview of Massachusetts Taxes. We mention the average number of hours worked per week in Massachusetts so the Massachusetts state hourly rate calculation on the 5500000 salary example is clear. Massachusetts Change state Calculate your Massachusetts net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Massachusetts paycheck calculator.

Our Massachusetts State Tax Calculator will display a detailed graphical breakdown of the percentage and amounts which will be taken from your 8500000 and go towards tax. A flat state income tax rate of 51 applies to all incomes meaning every dollar of a 200000 earners income is fair game. As long as you work 20 or more of your full-time hours your employer will pay an extra 5 of the remainder of your pay and the government will pay 6167 of the remainder as well.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Check out our new page Tax Change to find out how federal or state tax changes affect your take home pay. Simply enter their federal and state W-4 information as well as their pay rate deductions and benefits and well crunch the numbers for you.

Massachusetts 30k Salary Example. The standard deduction dollar amount is 12550 for single households and 25100 for married couples filing jointly for the tax year 2021. Massachusetts has a reputation as being a high-tax state but the take-home pay for a 200000 earner is only slightly below the national average of 13670004.

This salary calculation is based on an annual salary of 5500000 when filing an annual income tax return in Massachusetts lets take a look at how we calculated the various payroll and incme tax deductions. Supports hourly salary income and multiple pay frequencies. Massachusetts 15k Salary Example.

State tax rates of 59 apply to any tax return whether filed by a single person or a married couple with 8000 or more in earnings. The tax is on the purchase or use of tangible personal property This includes nearly any purchasable good with some exceptions. How to calculate taxes taken out of a paycheck.

The government contribution is capped at 154175 per month.

Salary Guide For Ux Professionals Infographic Image Ux Jobs Salary Guide3 Salary Guide Web Design Quotes Digital Marketing Infographics

Social Network Launches For Social Media Industry Social Media Examiner S Networking Clubs Social Media Infographic Social Media Jobs Social Media Strategist

Average Software Developer Salaries In Different Us States Software Development Development Web Developer Salary

Here S How Much Teachers Make In Every State Teacher Salary By State Elementary Teacher Salary Teacher Salary

Which College Degrees Get The Highest Salaries Which College Degrees Get The Highest Salaries If Youre A College Degree College Majors Types Of Education

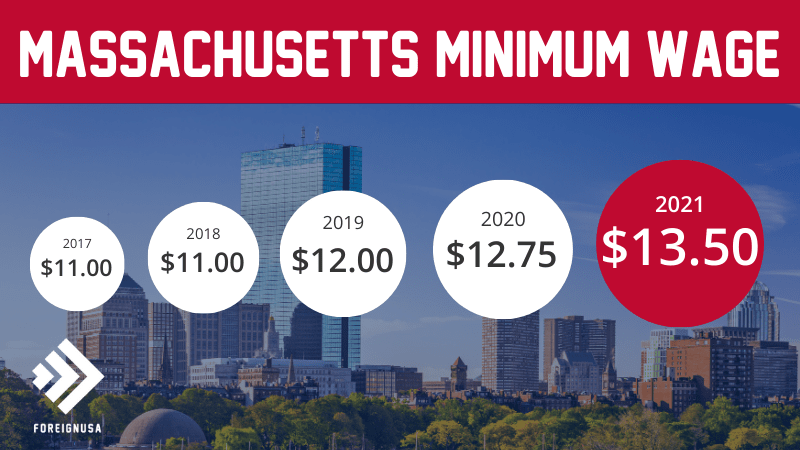

Minimum Wage In Massachusetts Massachusetts Minimum Wage 2021

Healthcare Management Salary Defenderauto Info Healthcare Management Health Care Infographic Health

Massachusetts Teaching Salaries And Benefits Teaching Certification Com

How To Earn A Decent Salary As A Virtual Assistant Small Revolution

Seo Salaires Usa Infographie Infographic Marketing Salary Guide Marketing Job

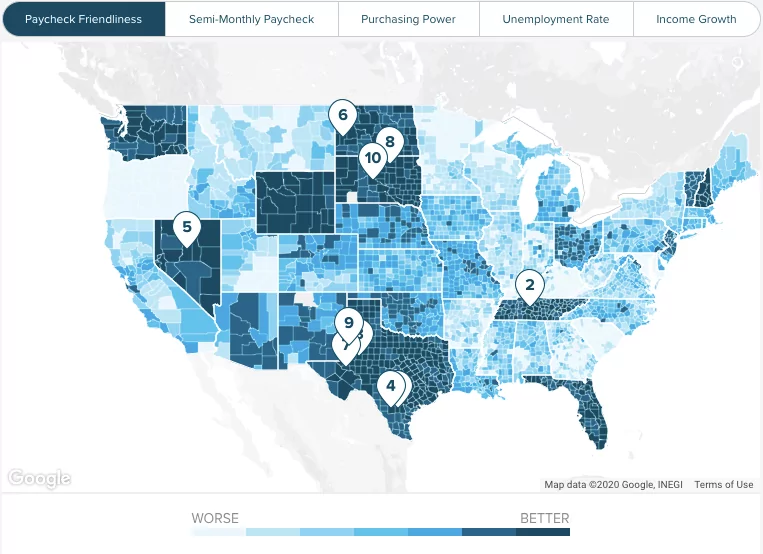

This Chart Shows The States Where Your Salary Will Go Further Career Advice Cost Of Living Job Hunting

Massachusetts Paycheck Calculator Smartasset

Massachusetts Paycheck Calculator Smartasset

How To Become A Furniture Designer The Art Career Project Creative Writing Major Furniture Designer Design Career

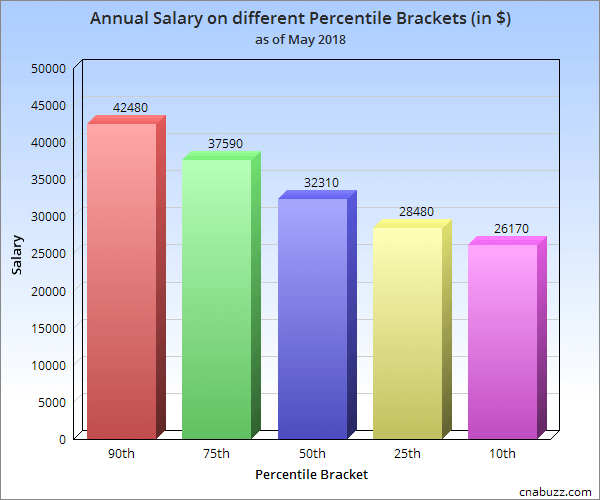

Cna Salary In Massachusetts Nursing Assistant Salary Outlook 2018

Women S Earnings In Massachusetts 2019 New England Information Office U S Bureau Of Labor Statistics

New Tax Law Take Home Pay Calculator For 75 000 Salary

Salary Structure In India Salary Business Infographic Tax Payment

The Social Media Salary Guide Infographic Social Media Jobs Social Media Social Media Apps

Post a Comment for "Take Home Salary Massachusetts"