Monthly In Hand Salary Calculator Usa

One of a suite of free online calculators provided by the team at iCalculator. 85000 Federal and State Tax Calculation by the US Salary Calculator which can be used to calculate your 2021 tax return and tax refund calculations.

Online Income Tax Calculator Calculate Income Taxes For Fy 2020 21 Scripbox

By default the US Salary Calculator uses the latest tax information as published by the IRS and individual State Governments though you can choose previous tax years is required 202122 is simply the default tax year used for the Federal Income tax calculations and State Income tax calculations.

Monthly in hand salary calculator usa. For example if an employee earns 1500 per week the individuals annual income would be 1500 x 52 78000. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. Next select the Filing Status drop down menu and choose which option applies to you.

If you are filing taxes and are married you have the option to file your taxes along with your partner. The employment contract would specify the wages with the payment usually made each month. This number is the gross pay per pay period.

The PaycheckCity salary calculator will do the calculating for you. Budget 2021-22 update This calculator has been updated with tax changes set out in the 2021-22 Budget. Why not find your dream salary.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. To calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year. If you are paid an even sum for each month to convert annual salary into monthly salary divide the annual salary by 12.

This calculator is always up to date and conforms to official Australian Tax Office rates and formulas. All bi-weekly semi-monthly monthly and quarterly. The salary calculator consists of a formula box where you enter the Cost To Company CTC and the bonus included in the CTC.

Using the United States Tax Calculator is fairly simple. Dont want to calculate this by hand. The regular payment made by the employer to the employee for the work is called the salary.

In-Hand Salary Monthly Gross Income Income tax Employee PF Other deductions if any The deductions could vary from each company and are based on. The Salary Calculator tells you monthly take-home or annual earnings considering UK Tax National Insurance and Student Loan. Hourly rates and weekly pay are also catered for.

The United States US Salary Calculator is a versatile salary calculator that allows you to calculate your salary after tax in any state in the United States. Employers then match those percentages so the total contributions are doubled. The Salary Calculator tells you monthly take-home or annual earnings considering Federal Income Tax Social Security and State Tax.

First enter your Gross Salary amount where shown. Also known as Gross Income. Salary After Tax.

The average monthly net salary in the United States is around 2 730 USD with a minimum income of 1 120 USD per month. How to Calculate Monthly Salary Monthly In Hand Salary CTC Deductions. What is a 85k after tax.

Using the United States Tax Calculator. Youll then get a breakdown of your total tax liability and take-home pay. Can be used by salary earners self-employed or independent contractors.

Hourly rates weekly pay and bonuses are also catered for. Simply enter your annual or monthly income into the tax calculator above to find out how taxes in Canada affect your income. This includes the extension of the Low and Middle Income Tax Offset LMITO for the 2021-22 tax year.

If you are paid in part based on how many days are in each month then divide your annual salary by 365 or 366 on leap years then multiply that number by the number of days in the month to calculate monthly salary. See how we can help improve your knowledge of Math Physics Tax Engineering and more. Use this calculator to quickly estimate how much tax you will need to pay on your income.

6270250 net salary is 8500000 gross salary. Income you have in excess of 200000 single filers 250000 joint filers or 125000 married people filing separately is subject to an additional 09 Medicare surtax which your employer wont match. The salary calculator is a simulation that calculates your take-home salary.

To find your monthly take home salary enter the cost to company CTC and basic salary in Take Home Pay Calculator. The latest tax information from 2021 is used to show you exactly what you need to know. Why not find your dream salary too.

The adjusted annual salary can be calculated as. Also explore hundreds of other calculators addressing topics such as tax finance math fitness health and many more. 30 8 260 - 25 56400 Using 10 holidays and 15 paid vacation days a year subtract these non-working days from the total number of working days a year.

This places US on the 4th place out of 72 countries in the International Labour Organisation statistics for 2012. Free calculator to find the actual paycheck amount taken home after taxes and deductions from salary or to learn more about income tax in the US. The latest budget information from April 2021 is used to show you exactly what you need to know.

How to calculate taxes taken out of a paycheck. Workers have to pay 145 of their wages for the Medicare tax and 62 for the Social Security tax. It is the total salary an employee gets after all the necessary deductions.

In Hand Salary Calculator Monthly Basic Salary. Overview of Texas Taxes Texas has no state income tax which means your salary is only subject to federal income taxes if. Salary Before Tax your total earnings before any taxes have been deducted.

It is calculated by taking the monthly gross income and subtracting various other taxes. Subtract any deductions and payroll taxes from the gross pay to get net pay.

Comparison Of Uk And Usa Take Home The Salary Calculator

Paycheck Calculator Take Home Pay Calculator

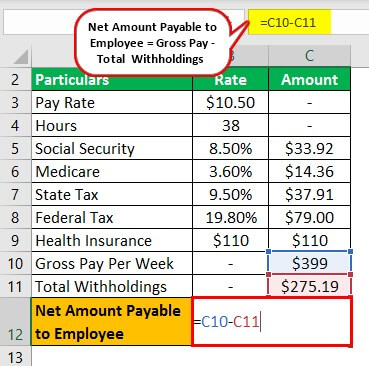

Payroll Formula Step By Step Calculation With Examples

Paycheck Calculator Take Home Pay Calculator

Salary Calculator Difference Between Gross Salary And Net Salary

How To Calculate In Hand Salary Quora

Household Monthly Budget Spreadsheet Budget Calculator Monthly Spending Tracker Monthly Budget Spreadsheet Budget Calculator Monthly Budget

What Is An Amortization Schedule Use This Chart To Pay Off Your Mortgage Faster Clark Howard

25 Great Pay Stub Paycheck Stub Templates Excel Templates Payroll Template Salary

Avanti Gross Salary Calculator

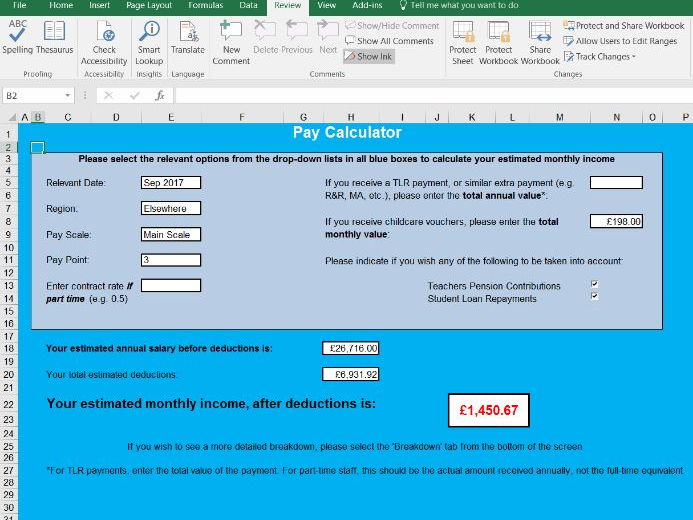

Pay Calculator Teaching Resources

Payroll Calculator Free Employee Payroll Template For Excel

Salary Calculator In Hand Salary Calculator Great Learning

Online Income Tax Calculator Calculate Income Taxes For Fy 2020 21 Scripbox

What Is Annual Income How To Calculate Your Salary Salary Calculator Income Income Tax Return

2021 Salary Paycheck Calculator 2021 Hourly Wage To Yearly Salary Conversion Calculator

Post a Comment for "Monthly In Hand Salary Calculator Usa"