Gross Income Calculation For Ppp

Comparing gross receipts in a quarter of 2020 with that same quarter in 2019. Your salary as an owner is defined by the way your business is taxed.

Pessimism About The Future Advanced Economy Purchasing Power Parity Data Visualization

The change opens the door for larger loans to self-employed individuals many of whom dont record much if any.

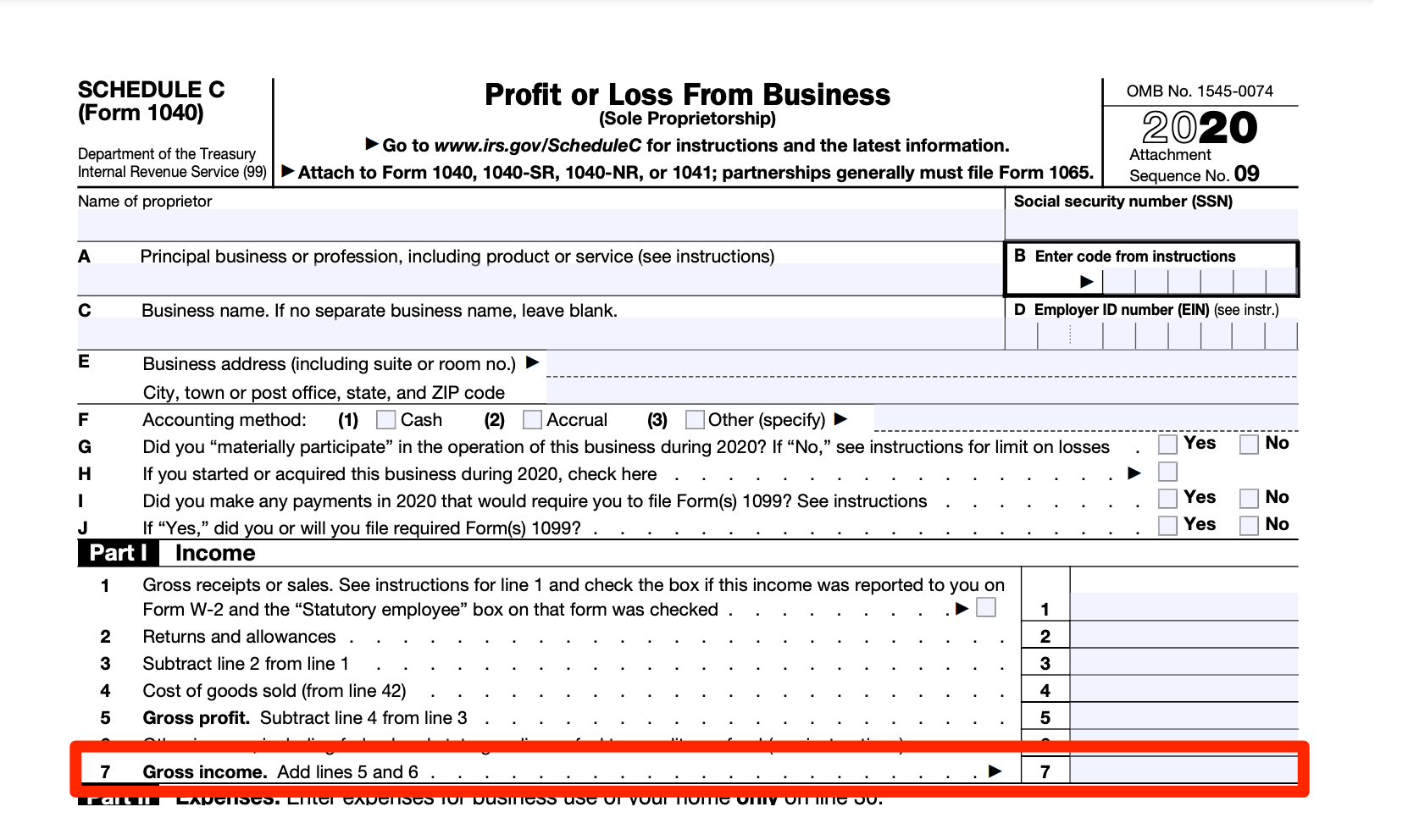

Gross income calculation for ppp. Small Business Administration SBA issued new Paycheck Protection Program PPP rules that allow self-employed individuals who file Form 1040 Schedule C Profit or Loss From Business to calculate their maximum loan amount using gross income instead of net profit. To mitigate the risk of fraud a Schedule C filer that reports more than 150000 gross income to calculate its first-draw PPP loan will not be able to claim the safe harbor provided for borrowers that together with their affiliates received PPP loans of less than 2 million. Schedule C Sole Proprietor With Employees.

Note that owners compensation is still limited to 100kyr. Gross receipts of a borrowers affiliates unless a waiver of affiliation applies2 are calculated by adding the gross receipts of the business concern with the gross receipts of each affiliate3 For more information on what constitutes gross receipts by entity type see FAQ 5 below. PPP loans are calculated using the average monthly cost of the salaries of you and your employees.

Comparing annual gross receipts between 2019 and 2020 as reported on a completed tax return. Gross Income PPP loan calculator for Schedule C filers - Updated March 3 2021 by Hannah Smolinski. Self-employed individuals who file Schedule C will now be able to calculate their maximum loan amount using gross income.

In addition to further clarifying those items included and excluded from gross receipts for both for-profit and nonprofit borrowers the SBA confirmed that the revenue reduction analysis must be completed based on calendar quarters in 2020 versus 2019. PPP For Self Employed. How to Calculate PPP Loan Amount Using Gross Income - YouTube.

Add the sole proprietors 2019 Schedule C line 31 net profit up to 100000 to 2019 gross wages paid to employees up to 100000 max per employee to calculate the gross earnings portion of the loan amount calculation. PPP For Self Employed. How to Calculate PPP Loan Amount Using Gross Income.

For businesses that started in 2020. This calculation change only applies to loans approved after March 4 2021 and borrowers that have already had their loans approved cannot increase their PPP loan amount based on the new maximum loan formula. SBA Updates PPP GROSS INCOME Calculation Line 7 Self-Employed New PPP Loan First Draw Application - YouTube.

The calculation for self-employed farmers and ranchers with employees is the same as for Schedule C filers that have employees with several exceptions. Employer paid health insurance premiums included in Schedule C line 14 retirement. If youre a sole proprietor or self-employed and file a Schedule C your PPP loan is calculated based on your business gross profit or gross income.

The gross amount received as investment income such as interest dividends rents and royalties. If both your net profit and gross income are zero or less you are not eligible for a PPP loan. The 25 percent reduction in revenue is calculated one of two ways.

Gross Income is always higher than Net Profit or at least the same By using this figure most business owners will now have significantly higher owners compensation and thus PPP loan amounts. The new rule allows that a Schedule C filer who has yet to be approved for a PPP first- or second-draw loan in the current phase of the program can elect to calculate the owner compensation share of its payroll costs based on either net profit as reported on line 31 of Schedule C or gross income as reported on line 7 of Schedule C. Multiply the average monthly net profit or gross.

First in place of Schedule C line 31 net profit the difference between Schedule F line 9 gross income and the sum of Schedule F lines 15 22 and 23 for employee payroll should be used. Calculate the average monthly net profit or gross income amount divide the amount from Step 1 by 12. PPP Applicants Should Use Gross Payroll Approach in Calculations Says AICPA For the calculation of the Average Monthly Payroll cost under the Paycheck Protection Program.

How To Calculate Gross Income For The Ppp Bench Accounting

![]()

New Ppp Loan Calculations For Sole Proprietors Cfoshare

Ppp Loan Based On Gross Income For Self Employed Teacher Entrepreneurs

How To Calculate Gross Income For The Ppp Bench Accounting

How To Calculate Your Paycheck Protection Program Loan Amount Bench Accounting

Markup Vs Gross Profit Percentage The Beancounter

Ppp Loan Based On Gross Income For Self Employed Teacher Entrepreneurs

Tax Formula Tax Tax Deductions Above The Line

Ppp Loan Based On Gross Income For Self Employed Teacher Entrepreneurs

Excel Payroll Calculator Template Software Download Payroll Template Excel Spreadsheets Templates Payroll

Download Adjusted Gross Income Calculator Excel Template Exceldatapro Adjusted Gross Income Income Excel Template

How To Calculate Labor Costs The Small Business Owner S Guide Labour Cost Small Business Finance Finance

How To Calculate Adjusted Gross Income Agi For Tax Purposes Adjusted Gross Income Health Savings Account Tax Accountant

Ppp For Self Employed How To Calculate Ppp Loan Amount Using Gross Income Youtube

Ppp Loan Based On Gross Income For Self Employed Teacher Entrepreneurs

Post a Comment for "Gross Income Calculation For Ppp"