Year To Date Gross Income Calculator

From your payslip enter the total tax deducted to date in this tax year. Tax codes accepted at the moment are L P T V Y and BR D0 D1 NT 0T and K.

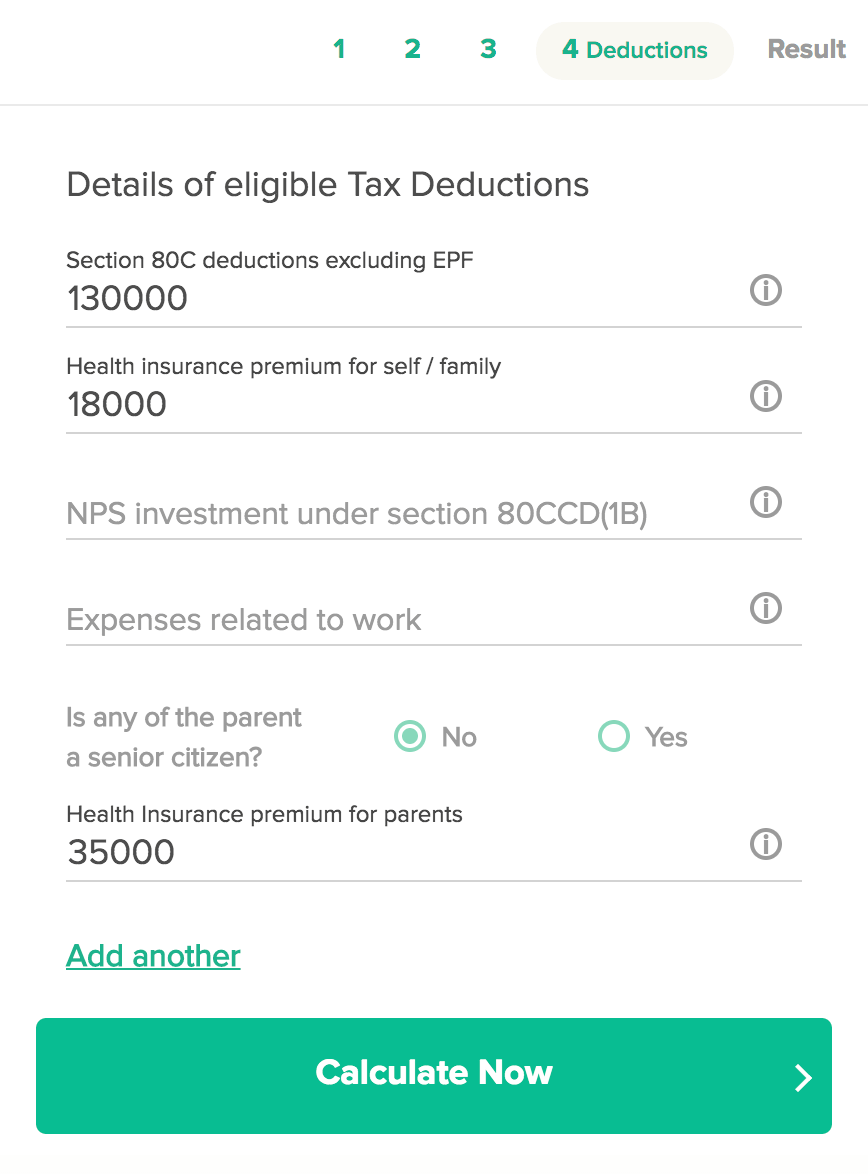

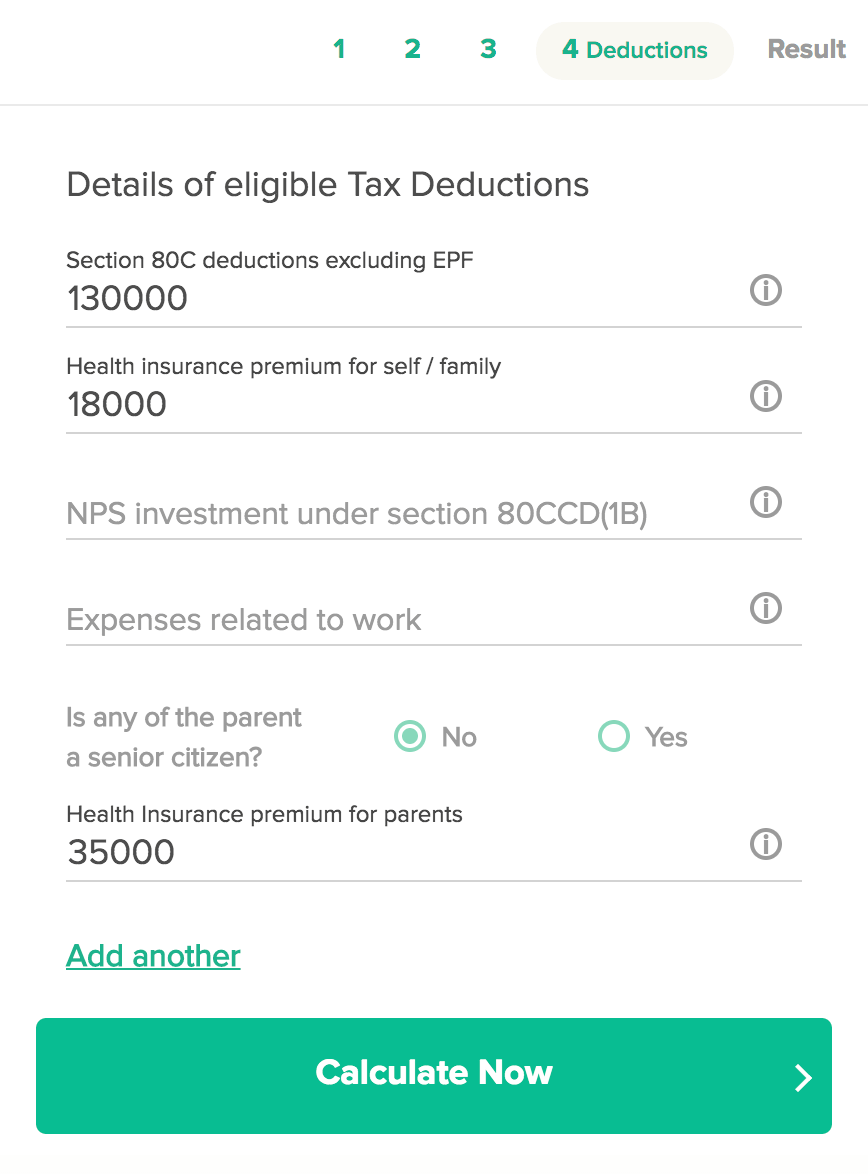

Online Income Tax Calculator Calculate Income Taxes For Fy 2020 21 Scripbox

Calculated figures are for reference only.

Year to date gross income calculator. Calculate the gross amount of pay based on hours worked and rate of pay including overtime. Budget 2021-22 update This calculator has been updated with tax changes set out in the 2021-22 Budget. This calculator is always up to date and conforms to official Australian Tax Office rates and formulas.

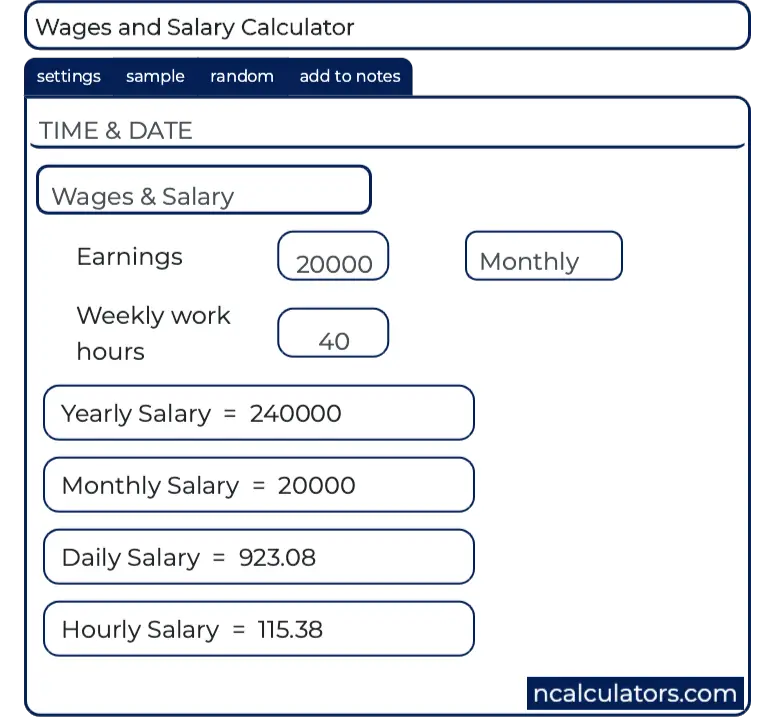

810L 747L 429P BR D1 etc. From your payslip enter the total gross income to date in this tax year. Net annual salary Weeks of work year Net weekly income.

Gross annual income - Taxes - Surtax - CPP - EI Net annual salary. Multiply your gross earnings per pay period times the number of pay periods leading up to a certain date to find your gross year-to-date earnings. For example divide year-to-date gross income of 23456 by 95.

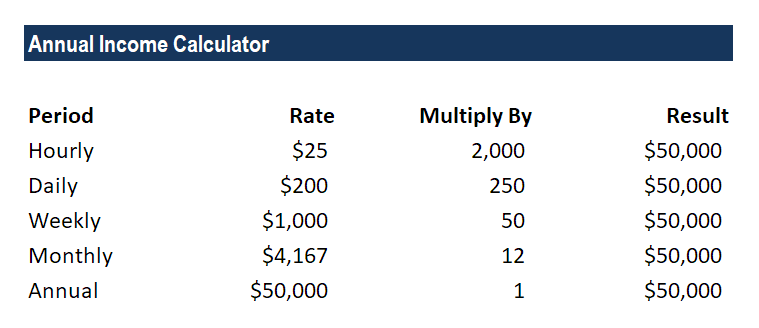

Hourly rates weekly pay and bonuses are also catered for. The PaycheckCity salary calculator will do the calculating for you. Use this calculator to quickly estimate how much tax you will need to pay on your income.

This means you can estimate work related stats from a past period year-to-date income etc or you can forecast the stats for a future period. For example consider a situation in which you want to determine your year-to-date earnings at the end of March. Our free easy-to-use online income annualisation calculator tells what youre likely to earn this year based on how much money youve received so far.

Use this date ONLY if the person whose income is being verified has not been employed with their current employer since January 1st. Subtract any deductions and payroll taxes from the gross pay to get net pay. This salary calculator estimates total gross income which is income before any deductions such as taxes workers compensation or.

Enter your tax code. All bi-weekly semi-monthly monthly and quarterly figures. The adjusted annual salary can be calculated as.

Specifically this calculator will calculate the number of work weeks workdays days off work-hours and gross income from one date to another. 1850 x 22 40700. It needs to be the full code ie.

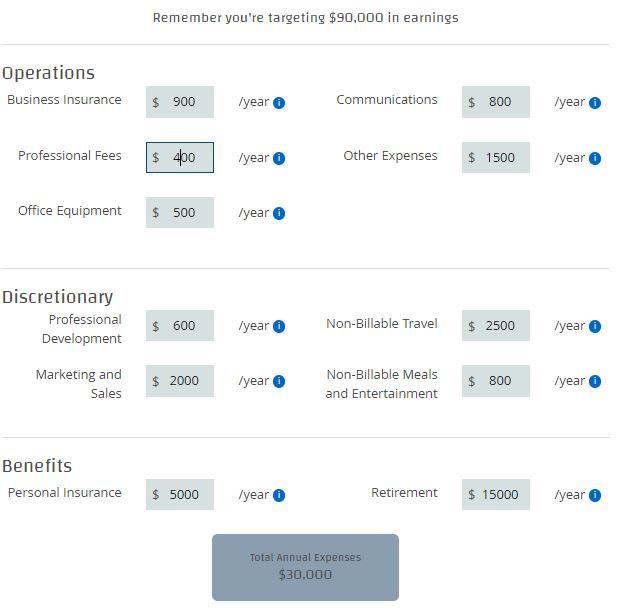

For example if you earned 40 000 last year and 50 000 this year no matter when you received those payments over the course of the years the lender adds the income for both years 40 000 50 000 90 000 and divides by 24 months to determine your average monthly gross income which is 3 750 in. This is so that income from that should not be used can simply be taken out in the calculator instead of the calculation being done. Why not find your dream salary too.

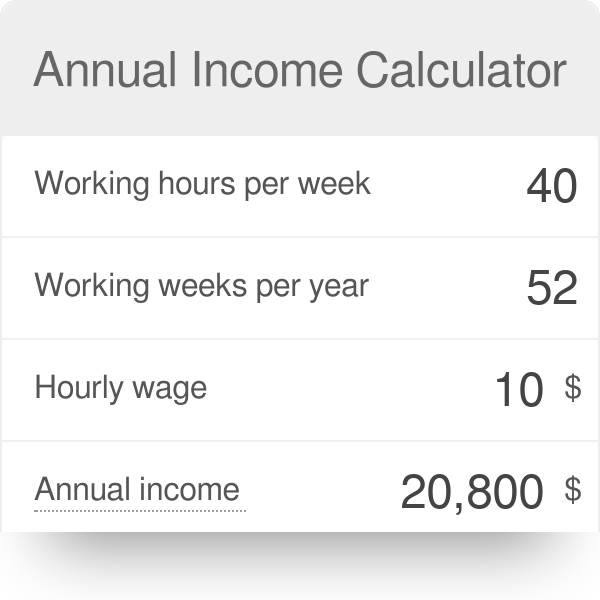

Next take the total hours worked in a year and multiply that by the average pay per hour. 30 8 260 - 25 56400. Take for example a salaried worker who earns an annual gross salary of 25000 for 40 hours a week and has worked 52 weeks during.

Ashley Carson Ali and Soraya. Your annual income is one of the key factors that lenders use to determine how much they are willing to offer for a residential mortgage. The latest budget information from April 2021 is used to show you exactly what you need to know.

W-2 Income is full year income from previous years this field will accept simple math instructions such as 13000 - 1500. This number is the gross pay per pay period. Gross vs Net Income.

The Salary Calculator tells you monthly take-home or annual earnings considering UK Tax National Insurance and Student Loan. Dont want to calculate this by hand. Contact credit center for income variances questions and or precise figures.

Divide the gross year to date income by number of months the figure represents. Ashley earned a total of 36000 in gross. Using 10 holidays and 15 paid vacation days a year subtract these non-working days from the total number of working days a year.

For example you have four employees at your business. Calculate your earnings to date with our income annualiser. Assume that there have been six pay periods by March 30.

To easily calculate your companys year-to-date payroll gather each employees pay stub and calculate the year-to-date gross incomes. To calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year. Net weekly income Hours of work week Net hourly wage.

Income Tax Calculator Calculate Income Tax Online Fy 2020 21

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

Net Salary Calculator Templates 13 Free Docs Xlsx Pdf Salary Calculator Payroll Template Salary

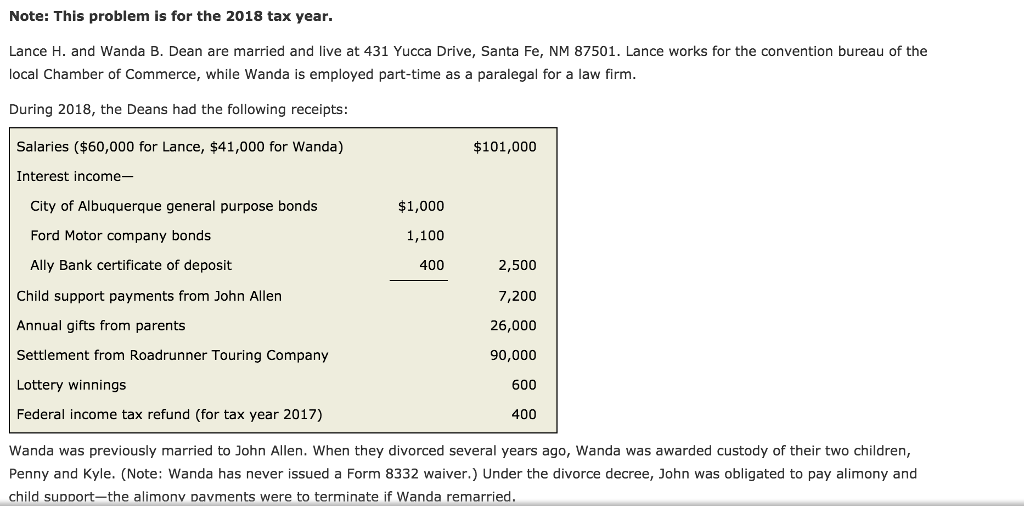

A 2 Calculate Taxable Gross Income 3 Chegg Com

How To Create Excel Data Entry Form With Userform That Calculates Income Tax Full Tutorial In 2021 Income Tax Income The Worksheet

Between Dates Income Calculator Gross Wages And Work Stats Income Family Money Dating

29 Free Payroll Templates Payroll Template Payroll Checks Statement Template

How To Calculate Wages With Your Check Stub Payroll Template Statement Template Payroll Checks

Annual Income Learn How To Calculate Total Annual Income

Excel Payroll Calculator Template Software Download Payroll Template Excel Spreadsheets Templates Payroll

Monthly Gross Income Calculator Freeandclear

Guide To Taxable Income For Individuals How To Calculate Your Taxable Income Amount Estimated Tax Payments Federal Income Tax Income

Javeed Ahmed On Instagram A Program To Calculate Simple Arithmetic Using Python In Pydroid App Python Programming Programming Tutorial Arithmetic Python

Social Security Benefits You Can Check Estimated Social Security Benefit Calculator Includ Social Security Benefits Adjusted Gross Income Disability Benefit

Payroll Calculator Templates 15 Free Docs Xlsx Pdf Payroll Template Payroll Check Template

Gross Annual Income Calculator

What Is Gross Vs Net Income Definitions And How To Calculate Mbo Partners

Post a Comment for "Year To Date Gross Income Calculator"